If you have looked at other article you now know what you are getting in too, we will therefor go through the “how” of CFD trading. There are basically five points from here until you are ready to make your first trade and they are as follow;

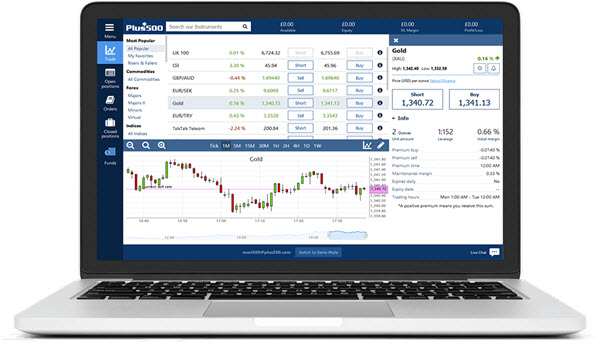

When you are getting started you can be overwhelmed by the shear amount of markets there will be to chose, there are literally thousands. But fear not, this is a big advantage and it will enable you to find a market of which you possess some knowledge about, is it bonds, Forex or commodities. If you already know what you want to trade in, there will usually be some kind of search or selection tool to get you right where you want to be.

When you are getting started you can be overwhelmed by the shear amount of markets there will be to chose, there are literally thousands. But fear not, this is a big advantage and it will enable you to find a market of which you possess some knowledge about, is it bonds, Forex or commodities. If you already know what you want to trade in, there will usually be some kind of search or selection tool to get you right where you want to be.

So when you are starting up any CFD trade you have two main options, you can buy or sell. When bringing up the trading ticket, two prices will be shown; the bid and the offer. The bid price is what you can sell the asset for and the offer price is what you can buy it for.

Always remember that these prices are rooted in the value of an underlying asset, so if you have knowledge about a certain market now is the time to use it. If you for any reason think the market price of a certain asset is about to rise, you should buy, and vice versa if you think the market price of a certain asset will fall, you should sell.

You found your asset, you figured to buy or to sell, now it is time to determine just how many CFDs you want trade. This can be a little bit tricky. Depending on what you trade the values of a single CFD can vary, so be aware! You trading in bonds, Forex, Indices or commodities the value of a single CFD will be related to whatever instrument that lies underneath. This information can be found in the option called “tick value”. When you are trading in equity, a single CFD will be equal to one share.

You will not need to make huge positions to make a big profit.

This is the point where you will start outlining your strategies as a trader. With the tools of stops and limits you will be able to manage the risk you are willing to take on you position. Place a stop, to close down a trade when it reaches a set low point to minimize your losses on an asset. You do not want to be in on an asset in free fall, since this can end up costing you a lot!

When you use the limit tool it is the other way around. This tool is made to pull you out of a trade when prices are better than when you started. This is done so you will not sit with the asset on the bad site of a market spike.

You now have a full trade in place. Now all that is left to do is keeping an eye on the market, since your profits will be based on the ever changing market prices of the underlying assets. Most platforms will show you the fluctuating market in real time, which is where you will spot market trends. What you do with this knowledge is closing down trades which are not performing as you wanted them too, maximizing for profits or minimizing your losses. Usually all you have to do is choosing the option “Close position”.

This article was last updated on: February 26, 2018